Empowering Rural India With Innovative Financial Solutions

Ezeepay: Empowering Rural India with Innovative Financial Solutions

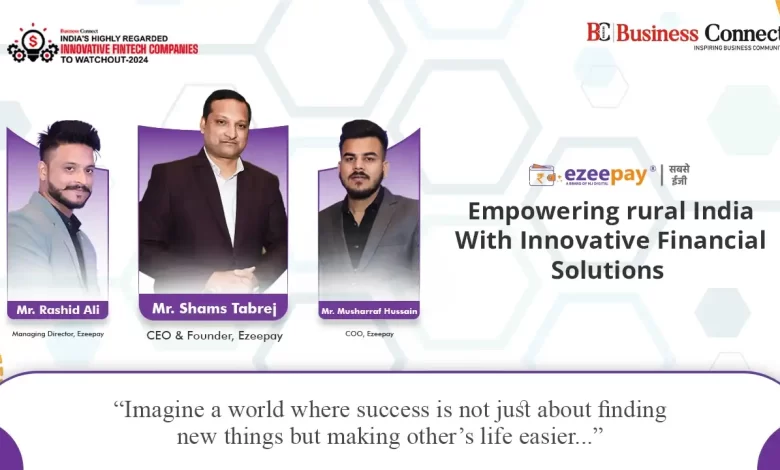

India’s Highly Regarded Innovative Fintech Companies To Watchout-2024

Just imagine a landscape in rural regions where the grasp of traditional banking is changed forever. Now, envision a groundbreaking concept—a comprehensive model formulated to easily deliver banking services to the common people without charging any additional fees….

Not only does this model has the potential to empower individuals with effortless access to financial services, but it also presents a unique opportunity for local shopkeepers to bag more lucrative offerings by catering services like cash withdrawal and money transfers. All of this is done by transforming their shops into mini banks through AePS, micro-ATMs, and swift money transfer mechanisms!!!

And we have brought to you one such innovative success story of a venture that happened to turn this concept into reality… Yes, it is none other than EzeePay… The trailblazing innovator behind this transformative model, turning the dream of accessible rural banking into a tangible reality.

Business Connect is truly amazed by the sheer brilliance and foresight showcased in EzeePay’s approach to rural fintech development. And, we can say that its vision has the power to revolutionize the financial landscape, empowering communities, fostering economic growth, and paving the way for a brighter, more inclusive future. For EzeePay it is not just banking. It is a beacon of hope and progress for the world so far.

We sat down to discuss the impact created by EzeePay with the senior leadership team. The trio of three visionaries laid the foundation of this venture 7 years ago. Shams Tabrej, Founder and CEO, Rashid Ali, Managing Director and Musharraf Husain, Chief Operating Officer wanted to bring waves of change to the fintech services space by targeting rural areas which are often overlooked by the business community. And today, Ezeepay is creating marvels by adding immense value to rural communities with its inclusive and considerate model.

How are they different from others?

EzeePay’s impact in the market is nothing short of phenomenal. At present, the venture is standing out amidst numerous enterprises that have come and gone. But, what sets EzeePay apart is its ceaseless commitment to service excellence and innovative solutions that could make a difference to the common people. While others may falter, the brand has proven the resilience and potential of its model, especially in terms of empowering remote village communities by offering them sustainable income sources.

In addition to this, their contribution to Digital India’s vision is obvious and worth many praises. With each initiative and service they offer that includes considerably beneficial commissions to the users is equally contributing to the country’s digital transformation. What’s truly remarkable is their focus on end-user benefits, prioritizing customer satisfaction and societal impact over mere profit margins. This ethos not only reflects their deep-rooted faith in their model but also showcases their approach to bringing real change to people’s lives through technology.

Moreover, EzeePay grabbed countrywide attention in 2023 by appointing the renowned actor, Jimmy Shergill, as their brand ambassador. Though the tenure has ended and would be renewed for this year soon, Jimmy Shergill’s esteemed endorsement reaffirmed EzeePay’s position as a pioneering leader in innovative financial technology, delivering unparalleled convenience and empowerment to people across various demographics.

The corporate profile

EzeePay Digital Bharat takes immense pride in its pioneering role as a prominent service aggregator and payments solution provider based in India. At present, they have a diverse portfolio encompassing over 60 services such as AEPS, Domestic Money Transfer, Mobile recharge, Bill Payments, insurance, and Travel bookings (Bus, Railway, Flight). EzeePay Digital Bharat has been offering a comprehensive suite of solutions to cater to the diverse needs of its customers.

The core concept behind the company centers around simplifying and enhancing banking accessibility in rural areas of India. The team is wholeheartedly committed to making financial transactions more straightforward and convenient for the residents of these regions.

On top of this, there is a focus on empowering local shopkeepers by providing them with additional income opportunities and recognizing their strong connections within the community. Their power is rooted in the belief that personal connections play a crucial role in financial matters, particularly in rural settings.

Tech integration

The trio of the leaders stated they believe in fostering integration of blockchain technology ensures the security and transparency of financial transactions. They target areas like Domestic Money Transfer and insurance, fostering trust among users, particularly in rural regions.

Based on the power of Artificial Intelligence, they enable personalized services by analyzing user behavior and transaction patterns, enhancing the overall user experience and aiding in risk assessment and fraud detection. They have also opted for robust cybersecurity measures including advanced encryption and multi-factor authentication.

They protect user data and fortify the ecosystem against cyber threats. The incorporation of AI-driven automation enhances operational efficiency by streamlining tasks and allowing the team to focus on delivering seamless services. The team is pretty positive about the AI inclusivity in the upcoming year in their business model.

Maintaining the user experience

The company prioritizes the user experience (UX) and is intensely focused on customer satisfaction that are central tenets of the company’s fintech product development strategy.

The very first step begins with the product development that comes with a deep understanding of user needs, behaviors, and pain points. It is done using user-centric design principles to create intuitive interfaces refined through continuous user research, feedback loops, and usability testing. Designing products to be accessible across demographics and regions, considering factors like language preferences, literacy levels, and technological proficiency to ensure usability for users, including those in rural areas.

Creating seamless onboarding experiences with clear processes, user-friendly tutorials, and educational materials to empower users to navigate and benefit from services easily. Actively seeking and incorporating customer feedback to make data-driven improvements, ensuring products evolve in line with user expectations and preferences.

Integrating robust security measures and transparent communication about security protocols to instill confidence in users regarding the safety of financial transactions and personal information.

Providing responsive multi-channel support, FAQs, and educational resources to assist users, along with regular communication and engagement initiatives to foster a sense of community and trust. Staying agile and adapting products to meet emerging user requirements, ensuring solutions remain relevant and valuable in the dynamic fintech landscape.

Scalability of fintech solutions

There has to be a robust tech infrastructure handling increasing transaction volumes and user demands, while regulatory compliance ensures seamless expansion into different markets without legal hurdles. Hence, EzeePay ensures to rely on robust cybersecurity measures fosters trust and confidence, safeguarding user data and enabling fintech solutions to scale securely.

There is a flexible and scalable business model, coupled with a simple and intuitive user interface, facilitates adoption, user retention, and overall scalability. Collaborations with other fintech entities or financial institutions, leveraging data analytics, artificial intelligence, and effective customer acquisition and retention strategies, support sustained growth and scalability. Expanding globally while considering local regulations, fostering innovation, and incentivizing user participation with commission and cashback incentives further enhance the scalability and appeal of fintech solutions.

Partnerships with Local Entities

For the upcoming years, the company plans to expand its merchant network by expanding their reach to more underserved areas. In regards to the future endeavors include introducing advanced fintech solutions, enhancing user experiences and collaborating with strategic partners.

By utilizing the potential of emerging technologies, like blockchain and AI, they would continually evolve its services. Above all, the company remains committed to breaking barriers and bringing comprehensive financial solutions to every corner fostering economic empowerment on a broader scale.

The parting words

Imagine a world where success is not just about finding new things, but making others’ lives easier. At Ezeepay, we believe that true success lies in serving others. Focus on making a positive impact, strive to bring comfort to those around you, and success will naturally follow. Your dedication to improving the lives of others is a powerful catalyst for personal and professional fulfillment. Keep making a difference!